Pay and price pressures showed fresh signs of retreating from the economy, adding to evidence that inflation is moving closer to the Federal Reserve’s goal.

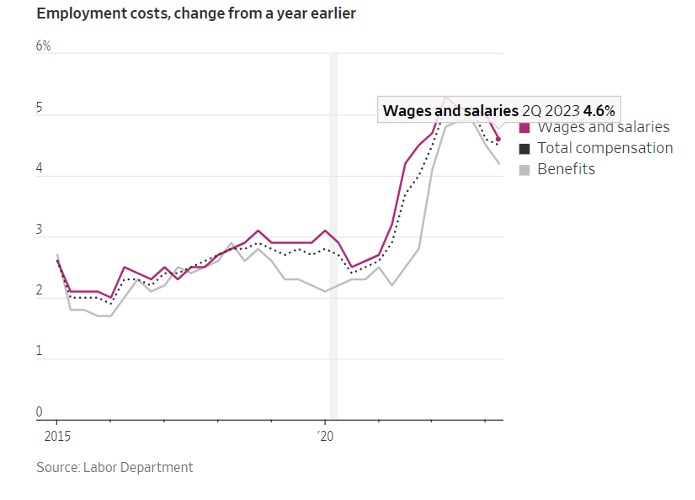

Employers spent 4.5% more on wages and benefits in April to June from a year earlier, the Labor Department said Friday. That marked a slowing from a 4.8% increase the prior quarter. The employment-cost index, a measure of compensation growth closely watched by Fed officials, also posted its smallest quarterly increase in two years.

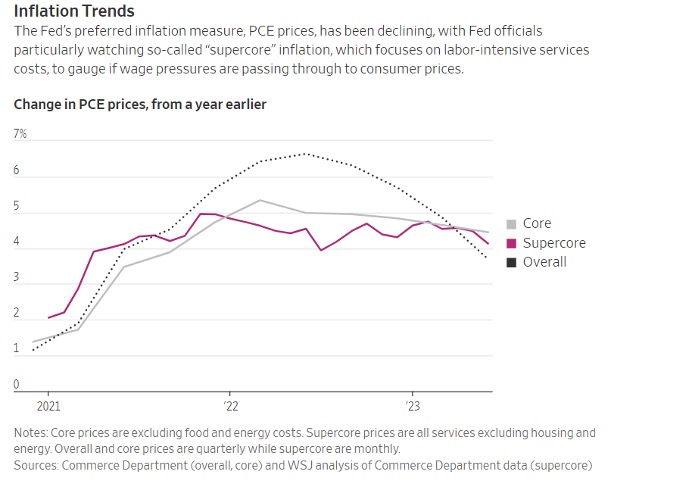

The personal-consumption expenditures price index, the Fed’s preferred inflation measure, rose 3% in June from a year earlier, the Commerce Department said separately Friday, down from a 3.8% rise the prior month.

U.S. stocks rose Friday after release of the inflation figures and as blue-chip earnings rolled in.

Wage growth and inflation remain elevated and faster than the Fed would prefer. But Friday’s figures offered the clearest signs yet of a long-anticipated slowdown in price pressures that, if they are sustained in the coming months, would allow the central bank to hold rates steady at its next meeting in September and possibly through the end of the year.

The Fed raised interest rates this week by a quarter-percentage point to a range between 5.25% and 5.5%, a 22-year high and the 11th increase since last year. Officials have raised rates more than they projected one year ago because underlying inflation and wage growth until very recently appeared to be settling at higher levels than they anticipated.

Fed Chair Jerome Powell said after this week’s policy meeting that any further increases would depend on whether inflation and economic activity were slowing in line with officials’ forecasts.

“Inflation repeatedly has proved stronger than we and other forecasters have expected, and at some point that may change,” he said. “We have to be ready to follow the data.”

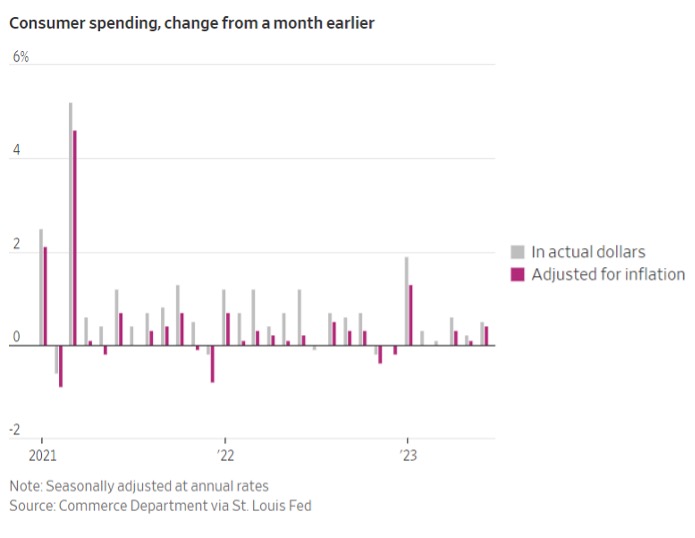

The U.S. economy grew solidly last quarter. Consumer spending, the primary driver of economic growth, rose in June for the sixth consecutive month and is increasing faster than inflation. The labor market has cooled this year compared with 2022 but remains on sound footing.

Restaurants, hotels and other businesses in the leisure and hospitality industry have seen robust wage gains amid labor shortages in the aftermath of the pandemic, a factor driving services price increases as goods prices cool.

Senior Fed officials have focused attention recently on a subset of prices for labor-intensive services by excluding food, energy, shelter and goods. Officials are trying to get inflation back to their 2% goal and believe that category could reveal whether wage pressures from the labor market are passing through to consumer prices, especially because they have expected price increases for housing and goods to slow.

That reading rose 3.2% in June on a three-month annualized basis, according to Wall Street Journal calculations, down sharply from 3.7% the prior month.

Growth in wages and salaries slowed to 4.6% from a year earlier, Friday’s data showed. That level was too high to be consistent with the Fed’s inflation target, said Andrew Hunter, deputy chief U.S. economist at Capital Economics.

Fed officials are likely to see 3.5% annual wage growth as consistent with inflation between 2% and 2.5%, assuming productivity grows around 1% to 1.5% a year.

“The speed of the decline we’re now seeing is definitely a reason for encouragement,” Hunter said. “You have very clear signs that the sort of gradual cooling in labor market conditions that we’ve seen over the past several quarters is now feeding through” to wages, he added.

Compensation for private services industry workers rose 4.5% last quarter from a year earlier, Friday’s report showed, a cooling that matched gains for workers overall. However, wage and benefit growth at leisure and hospitality businesses outpaced overall gains.

Andrea Herrera, owner at Chicago-based Amazing Edibles Catering, said she is continuing to raise pay to retain and attract workers. Over the last two years, Herrera has lifted pay for existing workers by 20%-25%, raised the starting wage for new workers by $5 an hour and started offering a retirement-savings program, she said.

Herrera said she has turned down about a third of inquiries she has received for bookings this year because she doesn’t have enough chefs, waiters and bartenders. She anticipates revenue this year will be about $1 million less than it would have been if she were adequately staffed.

“It breaks my heart not to take work, but if we take work and we don’t do a good job and the clients aren’t happy, it doesn’t make any sense,” she said.

She is currently hiring for an executive chef and expects to pay that person around 25% more than she would have since the opening arose about 18 months ago.

Economists view the employment-cost index as one of the more comprehensive measures of wage growth. Annual gains in the index had been running hotter than average hourly earnings, a separate measure from the Labor Department that rose 4.4% in June from a year earlier.

Omair Sharif, president of the advisory firm Inflation Insights, said continued cooling of the overall labor market could give Fed officials a reason to hold off on another interest-rate increase at their mid-September meeting. Should the labor market continue to soften, so too should wage growth, he said.

“That should give more confidence about where things will eventually end up on inflation,” Sharif said.

Reference:

Amara Omeokwe, Harriet Torry, Nick TImiraos. 28 July 2023. Inflation and Wage Growth Ease as Fed Considers Next Move. The wall Street. https://www.wsj.com/articles/wages-and-inflation-ease-as-fed-considers-next-move-a6abd49b?mod=economy_lead_story

Swipe left and right to see everything