You know the drill: Bad news for the economy turns out to be good for stocks, and good news becomes bad. It’s happening again, and it’s all thanks to inflation—or more to the point, worries about inflation.

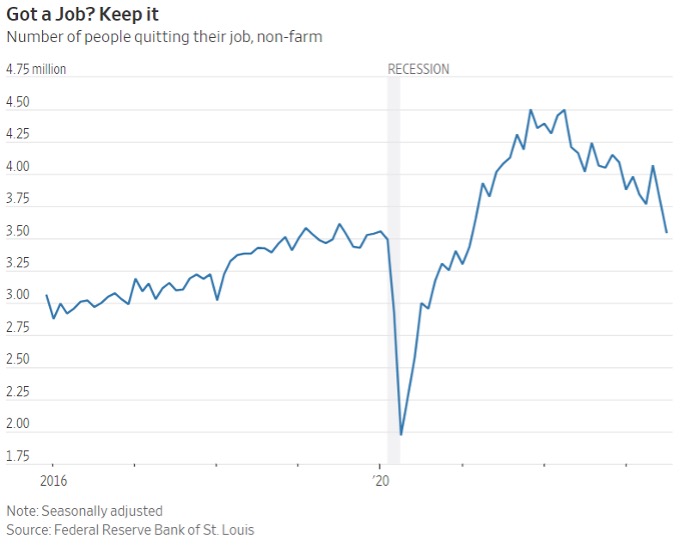

The latest example was the surprisingly weak job openings figures on Tuesday, which showed more than half a million fewer vacancies than economists had forecast and the number of job quitters back to pre-Covid levels.

Instead of taking that as a sign that companies see weaker demand and consumers are less confident, both bad for profits, investors welcomed the idea of a slowdown. There will be less pressure on the Federal Reserve to raise rates and keep them high, so bond yields fell and stock prices rose.

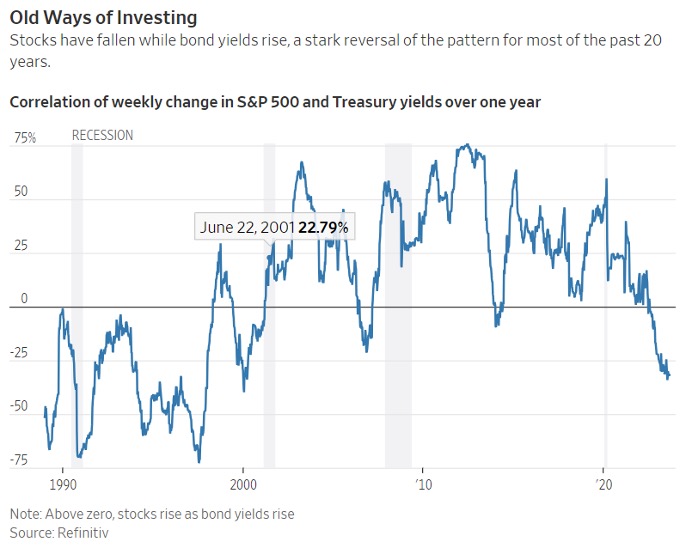

This could be part of a generational shift in how markets operate. For most of the 20th century—aside from the Great Depression, World War II and the Vietnam War—stocks and bond yields moved in opposite directions. But today’s investors grew used to stocks and bond yields going in the same direction, as they did from 2000 to 2021.

In the past two years, the pattern has reverted to the old normal, as inflation concerns came to the fore. There was a brief break earlier this year when investors thought inflation would fall back by itself, and the bull market in stocks took hold again. But in July—when stocks peaked—the old pattern took over, with 14 days in a row of the S&P 500 and 10-year Treasury yields moving in opposite directions, the longest period since 2009.

Broadly speaking, a stronger economy brings two conflicting things: Higher profits for companies, which are good for share prices, and more inflationary pressure that leads to higher interest rates, which are bad for share prices.

Right now investors are much more focused on the inflationary pressure than the profits, so higher bond yields come with lower stock prices. Equally, as on Tuesday, bad news on the economy is good for stocks, because it means less inflationary pressure.

When inflation isn’t a concern, then the prospect of higher profits dominates the threat of higher rates, and good news on the economy is good for stocks despite higher Treasury yields.

The new pattern makes life harder for investors. Treasurys provide less protection in a portfolio, because prices tend to move in the same direction as stocks (bond yields move inversely to prices). If stocks fall, so will bond prices, and the whole portfolio does badly, as last year’s painful experience should have seared into your memory.

Compare that to the previous regime, where Treasury prices helped to smooth a portfolio by tending to move in the opposite direction to stocks on any given day or week—while still making money over the long run.

Of course, in a recession all this goes out the window. The Federal Reserve slashes interest rates, there is a rush to buy Treasurys, and both stocks and bond yields tumble. But outside recession, Treasurys no longer offer the same day-to-day diversification from stocks. This ought to make them less appealing and push up their yield to compensate.

The question for investors is whether the negative link between stocks and bond yields will last. Measured on a weekly basis over the past year, the link is the most negative since 2000, which is about when it first flipped positive as investors lost their fear of inflation. But it waxes and wanes, and it’s hard to predict when investors will suddenly shift away from worrying about inflation, as they did for a few months this year, and the stock-bond correlation will reverse again.

I think inflationary pressures are here to stay, thanks to deglobalization, industrial policy, a corporate switch from efficiency to resilience and spending on defense and clean energy. That marks a sharp change from the “great moderation” that preceded the 2008 financial crisis, when investors were convinced that inflation had been conquered. It’s also very different to the long period of low rates and low inflation that followed it, when investors worried much more about recession than inflation.

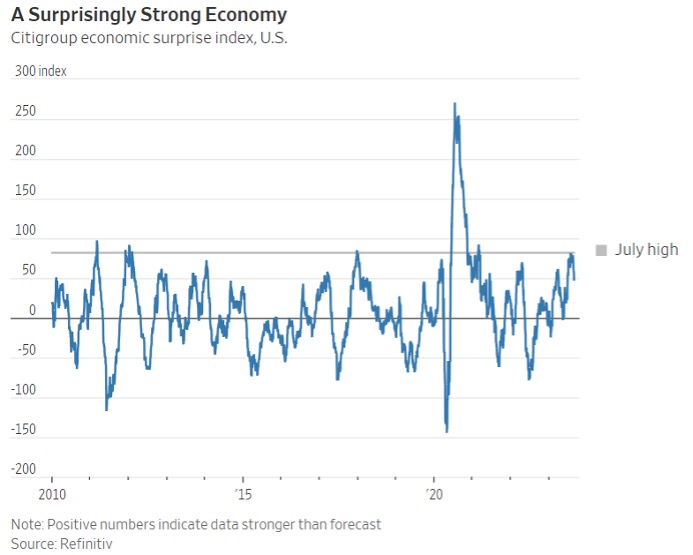

If I’m right, then investors will stay focused on inflation, hoping for the weak growth that would bring lower bond yields and boost the price of stocks. There’s a tension here. The economy has been surprisingly strong of late, which also means expectations for growth are higher—and more easily disappointed. Small bits of bad news could be good for stocks, as on Tuesday.

In the longer run, those without a strong view on the direction of inflation should expect their portfolios to be more volatile, as bonds no longer cushion daily stock-price moves. That hurts, adding unwanted risk and so making leverage less attractive. But for those simply buying a passive stock and bond portfolio for the long run, the best advice applies whatever correlations do: Don’t check what it’s worth except when you rebalance.

Reference:

James Mackintosh. Sept 1, 2023. The Generational Paradigm Shift Taking Over Markets. The Wall Street Journal.https://www.wsj.com/finance/investing/the-generational-paradigm-shift-taking-over-markets-e1e7d4e6?mod=finance_lead_story

Swipe left and right to see everything